Flexible revolving credit lines offer Real Estate homeowners a dynamic financing solution for unexpected expenses and home improvements, providing adaptability in borrowing and repayment while navigating market risks through strategic repayment strategies like structured plans, emergency funds, and rate lock agreements.

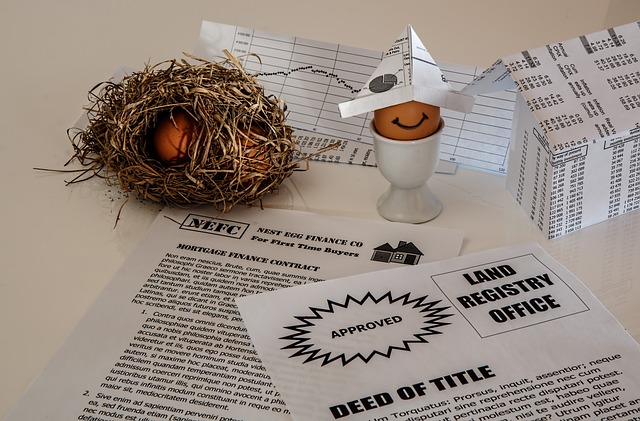

In today’s dynamic real estate market, understanding flexible revolving credit options can empower homeowners with unprecedented access and convenience. This article delves into the intricacies of flexible revolving credit in the context of real estate, exploring its benefits, risks, and effective repayment strategies. By navigating these dynamics, homeowners can leverage this tool for financial flexibility and strategic decision-making.

Understanding Flexible Revolving Credit in Real Estate

In the realm of Real Estate, understanding flexible revolving credit is a game-changer for homeowners seeking financial options. This innovative tool allows property owners to access a line of credit, offering both flexibility and convenience. Unlike traditional loans with fixed terms, flexible revolving credit provides a rotating balance, enabling borrowers to borrow, repay, and borrow again within set limits.

This feature is particularly advantageous in the dynamic Real Estate market where financial needs can fluctuate. Homeowners can tap into this credit line for various purposes, such as home renovations, unexpected expenses, or even investing in rental properties. The ability to access funds as needed makes it a versatile option, catering to the unique financial requirements of Real Estate owners.

Benefits for Homeowners: Access and Convenience

For homeowners, a flexible revolving credit line offers immense benefits that enhance their financial journey in the real estate sector. The primary advantage lies in its accessibility and convenience. With this type of credit, homeowners can draw funds whenever they need it, providing a safety net for unexpected expenses or opportunities like home renovations, repairs, or even home improvements to increase property value. Unlike traditional loans with fixed terms, a revolving credit allows borrowers to pay back what they use, when they can afford it, making financial management more adaptable and less stressful.

This feature is particularly appealing as it aligns with the dynamic nature of real estate. Homeowners can access capital for various purposes, from purchasing a new property to investing in home infrastructure, all while maintaining control over their finances. The flexibility also encourages responsible borrowing, enabling homeowners to manage their debt levels effectively without the pressure of strict repayment schedules, fostering financial stability and security.

Navigating Risks and Repayment Strategies

Navigating risks is an essential aspect of any credit arrangement, especially for flexible revolving credits tailored to homeowners in the real estate market. Lenders and borrowers must carefully consider potential challenges. These may include fluctuations in property values, unexpected financial setbacks, or changes in interest rates. A robust repayment strategy is crucial to mitigating these risks. Borrowers can opt for structured repayment plans that align with their income cycles, ensuring manageable monthly payments. Additionally, building an emergency fund and exploring options like rate lock agreements can provide protection against market volatility.

By implementing these strategies, homeowners can make informed decisions when utilizing flexible revolving credits. Such approaches foster financial stability and responsible borrowing, allowing individuals to access capital for real estate investments or home improvement projects with confidence.