Real estate financing benefits from charging interest only on utilized amounts, offering borrowers cost savings and simplicity. This approach reduces financial strain, avoids penalties for partial loan usage, and fosters healthier lender-borrower relationships. It also encourages efficient capital allocation for investors, streamlining processes via digital platforms and automated systems, ultimately enhancing the overall health of the real estate sector.

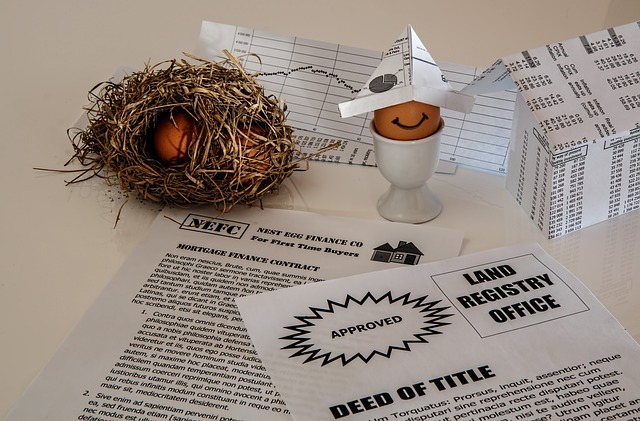

In the competitive world of real estate, understanding financing terms is key to making informed decisions. This article delves into a crucial aspect often overlooked: interest charged only on the utilized amount. We explore how this strategy can significantly impact your financial burden, offering both advantages and best practices for efficient real estate financing. By unraveling the benefits of this approach, we aim to empower buyers and investors alike in their search for optimal real estate deals.

Understanding Interest Calculation in Real Estate

Interest charged only on the utilized amount is a beneficial concept in real estate financing, offering borrowers a more flexible and cost-effective approach to managing their loans. In traditional lending models, interest accrues on the full loan amount, regardless of how much money is actually borrowed or used. However, with this innovative system, lenders calculate interest based on the outstanding balance, applying it only to the portion of the loan that has been utilized.

This method simplifies repayment and reduces financial strain for borrowers. For instance, let’s consider a property buyer who secures a mortgage for $300,000 but decides to move into their new home after utilizing only $250,000. With interest charged on the utilized amount, they will pay less in overall interest compared to a standard model where interest is calculated on the full loan value. This approach aligns with real estate principles by ensuring that borrowers are not penalized for partial loan usage, fostering a healthier financial relationship between lenders and borrowers.

The Advantage of Paying Only on Utilized Loan Amount

When it comes to financing a real estate venture, paying interest only on the utilized loan amount offers significant advantages over traditional models. This approach ensures that borrowers are not burdened with interest payments on idle funds, saving them substantial financial resources. By covering interest costs only for the money actually used, lenders and investors benefit from reduced risk and potential returns.

This strategy promotes efficient capital allocation in real estate projects. Instead of paying interest on a full loan amount, investors can direct their finances towards more productive areas, such as expanding properties or developing new assets. This efficiency gain is particularly beneficial for developers and property owners, allowing them to maximize the value of their investments while minimizing unnecessary financial commitments.

Best Practices for Efficient Real Estate Financing

Efficient real estate financing is a delicate balance between securing funds for properties and minimizing financial burden on both lenders and borrowers. Best practices in this domain focus on transparent communication, flexible terms, and fair interest structures. One key innovation that has gained traction is charging interest only on the utilized amount. This approach ensures that borrowers are not penalised for not borrowing to their full limit, aligning with prudent financial planning. It also encourages responsible borrowing, as lenders mitigate risks associated with non-utilized funds.

Implementing digital platforms and automated processes further streamlines financing procedures, making them less cumbersome for all parties involved. Real estate professionals should embrace technology that facilitates quick assessments, accurate document management, and seamless communication. These practices not only enhance the efficiency of real estate transactions but also contribute to a healthier financial ecosystem within the sector.