In real estate, charging interest only on the utilized portion of a mortgage (the 'utilized amount') saves borrowers money and promotes responsible borrowing. This method aligns interest payments with borrowed funds, lowering overall costs compared to traditional loans. Automating lending systems and clear communication enhance profitability for lenders while empowering borrowers to make informed decisions. Flexible repayment plans aligned with borrowers' cash flow reduce default risk and boost customer satisfaction in the competitive real estate market.

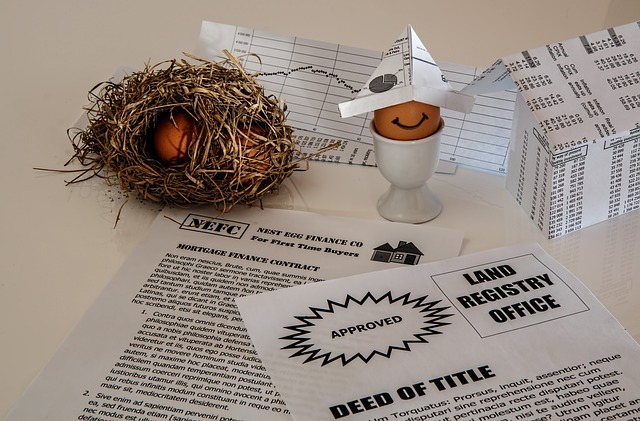

In the dynamic landscape of real estate, understanding interest calculation is paramount for both lenders and borrowers. This article delves into a strategy that offers significant advantages: charging interest solely on the utilized amount. By focusing on the actual borrowed sum, rather than the full loan value, this approach enhances financial transparency and flexibility. We explore the benefits, from reduced borrowing costs to improved cash flow management, and provide practical implementation strategies for efficient interest collection in real estate transactions.

Understanding Interest Calculation in Real Estate Loans

In real estate transactions, interest calculation plays a pivotal role in determining the overall cost of borrowing for prospective homeowners. Unlike some other types of loans where interest is calculated on the full loan amount, real estate loans often charge interest only on the utilized portion, also known as the ‘utilized amount’. This approach ensures that borrowers are not burdened with excess interest payments when they’ve only drawn a part of their mortgage. For instance, if you secure a $300,000 mortgage but only need $250,000 for your down payment and closing costs, your lender will calculate interest based on the utilized $250,000.

This method offers several benefits to borrowers. Firstly, it reduces monthly payments since interest is applied to a lower balance. Secondly, it can save significant sums in interest over the life of the loan. This is particularly advantageous for real estate investors and first-time homebuyers looking to minimize their financial outlay. By understanding how interest is calculated on their mortgage, borrowers can make informed decisions, compare different loan offers, and ultimately secure the best financing terms for their real estate purchases.

Advantages of Charging Interest Only on Utilized Amount

Charging interest only on the utilized amount in real estate transactions offers several significant advantages. One key benefit is cost savings for borrowers. Unlike traditional lending models where interest is calculated based on the full loan amount, this approach ensures that interest expenses align with the actual funds borrowed and used. This results in lower overall interest payments over the life of the loan.

Additionally, this system promotes responsible borrowing and efficient financial management. Borrowers are incentivized to keep their debt levels low, as they only pay interest on what they’ve actually utilized. This can help individuals and families avoid excessive debt and maintain better control over their finances. In the context of real estate, it encourages borrowers to invest in properties strategically and use funds responsibly, ensuring a mutually beneficial relationship between lenders and borrowers.

Implementation Strategies for Efficient Interest Collection

In the realm of Real Estate, efficient interest collection is a game-changer for lenders and investors. Implementing strategies that ensure interest is charged solely on the utilized amount can significantly impact profitability while mitigating financial risks. One effective approach is to adopt automated lending systems that accurately track and monitor loan usage in real-time. These systems enable precise calculation of daily or weekly interest, ensuring charges are applied only on the portion of the loan actually in use.

Additionally, establishing clear communication channels with borrowers can foster transparency and trust. Regular updates on loan utilization and associated interest rates can empower borrowers to make informed decisions about their financial obligations. Lenders can also offer flexible repayment plans tailored to borrowers’ cash flow patterns, promoting timely payments and reducing the risk of default. Such strategies not only streamline interest collection processes but also enhance customer satisfaction in the dynamic market of Real Estate.