Renovations are a driving force in the real estate sector, enhancing properties' aesthetics, functionality, and value, catering to evolving preferences and market trends. Sustainable practices, like smart home systems and solar panels, along with open concept living spaces, are prominent examples reshaping market dynamics. While initial costs for renovations can be high, long-term gains, including higher resale values and tax benefits, make them a powerful tool for investors.

In today’s competitive real estate market, renovations and improvements play a pivotal role in enhancing property values and appealing to buyers. Understanding these trends is crucial for both property owners and investors alike. This article explores the dynamic interplay between renovations and real estate, delving into popular design choices, financial incentives, and strategic considerations that drive market demand. By gaining insights into these key aspects, you’ll be better equipped to navigate the ever-evolving landscape of real estate.

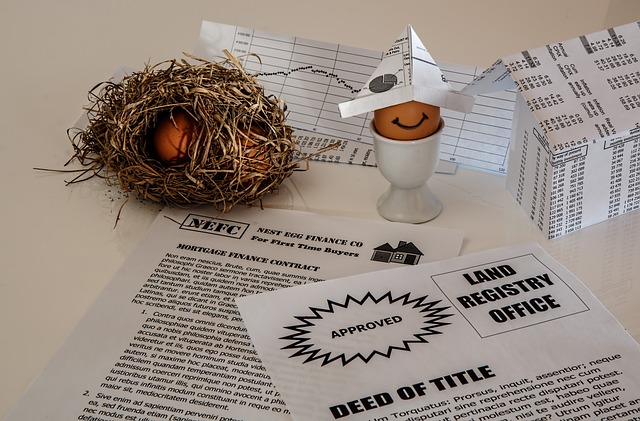

Understanding the Role of Renovations and Improvements in Real Estate

Renovations and improvements play a pivotal role in the real estate sector, offering both investors and homeowners numerous advantages. These processes involve transforming existing structures or properties to enhance their aesthetic appeal, functionality, and overall value. Whether it’s a minor facelift or a complete overhaul, renovations cater to evolving preferences, market trends, and lifestyle changes. For instance, updating outdated kitchens or bathrooms can significantly increase a property’s marketability and desirability.

In the competitive real estate landscape, well-executed improvements can set properties apart. They attract buyers seeking modern amenities, efficient designs, and personalized spaces. Moreover, renovations provide an opportunity to address structural issues, improve energy efficiency, and incorporate sustainable features, all of which contribute to long-term property health and savings. Understanding this dynamic relationship between renovations and real estate value is crucial for both those looking to invest in properties and those aiming to maximize their existing assets.

Popular Renovation Trends Shaping the Real Estate Market

The real estate market is ever-evolving, with renovation trends playing a pivotal role in shaping property values and preferences among buyers. One prominent trend is the shift towards sustainable and eco-friendly practices. Homeowners are increasingly opting for renovations that incorporate energy-efficient systems, such as smart home technology, improved insulation, and renewable energy sources like solar panels. These upgrades not only reduce utility costs but also appeal to environmentally conscious buyers, driving up property values in the process.

Another popular renovation trend is the focus on open concept living spaces. This design choice involves breaking down walls to create seamless interiors, fostering a sense of spaciousness and modern aesthetics. Open concepts are particularly desirable for families seeking versatile spaces that cater to various activities, from entertaining guests to relaxed evenings at home. These trends are significantly influencing real estate market dynamics, with developers and homeowners alike embracing innovative ways to enhance property appeal and functionality.

The Financial Benefits and Considerations for Property Owners

Renovations and improvements can be a great way for property owners to enhance their real estate investments, but it’s crucial to weigh the financial considerations. Initially, significant costs are often associated with construction projects, from material expenses to labor charges. However, the long-term gains can outweigh these initial investments. Property values tend to appreciate over time, and well-planned renovations can increase the marketability of a home, potentially leading to higher resale values.

Additionally, certain improvements may offer tax benefits. Many governments provide incentives for energy-efficient upgrades or structural renovations, allowing homeowners to deduct eligible expenses from their taxable income. These financial perks make it an attractive proposition for those looking to both beautify and smarten up their properties.