In today's competitive real estate market, understanding financing options like variable-rate loans tied to the prime rate is crucial. These loans offer flexibility by adjusting interest rates based on economic conditions, benefiting borrowers during stable markets but potentially increasing costs with rising rates. Real estate professionals should advise clients on timing purchases and managing debt obligations, as fluctuations in the prime rate significantly impact borrowing affordability and inflation. Investors can gain profitability through lower loan costs but must balance savings potential against risk of rising rates impacting affordability and investment returns.

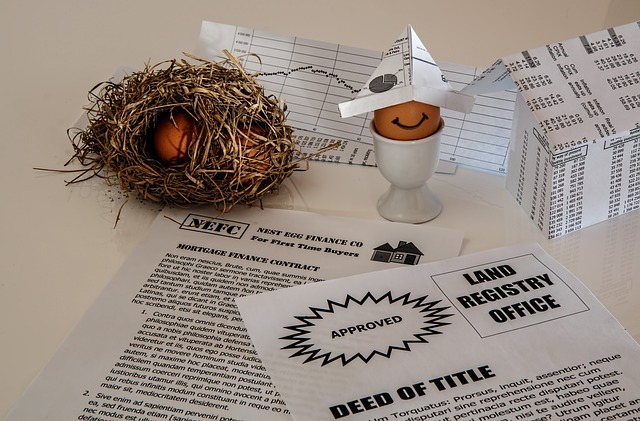

In today’s dynamic real estate market, understanding variable rate loans is crucial for both borrowers and investors. This article explores how variable rates tied to the prime rate influence real estate transactions, shedding light on their intricate relationship. We delve into the mechanics of these loans, analyze the prime rate’s role as a key benchmark, and discuss the benefits and considerations for real estate investors navigating this landscape.

Understanding Variable Rate Loans in Real Estate

In the competitive world of real estate, understanding financing options is paramount for both buyers and investors. One such option gaining traction is the variable-rate tied to prime loan. This innovative approach offers flexibility by adjusting interest rates over time, which can be advantageous in a dynamic market. By linking the loan’s rate to a benchmark index like the prime rate, borrowers benefit from initial lower rates that may decrease further if market conditions favor it.

Real estate professionals and enthusiasts should appreciate how this variable-rate structure can impact their financial strategies. During periods of economic growth, where interest rates tend to rise, these loans might not be the most cost-effective choice. However, in environments characterized by low inflation and stable markets, they provide an opportunity for savings, allowing borrowers to navigate changing rate landscapes with potential long-term benefits.

The Prime Rate: Its Role and Impact on Borrowing

The Prime Rate, set by banks based on their cost of borrowing from each other, acts as a benchmark for various loans including those in the real estate sector. It’s a key indicator that influences interest rates across different types of credit products. When the Prime Rate rises, so do the costs associated with mortgages and business loans. This can significantly impact homeowners and real estate investors by increasing their monthly repayments. Conversely, lower Prime Rates make borrowing more affordable, potentially stimulating economic activity in the real estate market.

In times of economic uncertainty, central banks often adjust the Prime Rate to control inflation or stimulate growth. These changes reverberate through the economy, affecting not just individual loans but also the overall accessibility and cost of credit. For real estate professionals, understanding these rate fluctuations is crucial for advising clients on timing their purchases or investments, as well as managing existing debt obligations.

Benefits and Considerations for Real Estate Investors

For real estate investors, variable rates tied to the prime rate offer a unique set of advantages. One significant benefit is enhanced flexibility; these adjustable rates allow investors to navigate market fluctuations effectively. When interest rates drop, so do loan costs, potentially increasing profitability and cash flow for property owners. This is particularly advantageous in the dynamic real estate market, where staying competitive is crucial for attracting tenants or buyers.

However, there are considerations too. While lower rates are enticing, they also introduce risk. If rates rise, so do borrowing costs, which could impact affordability and investment returns. Real estate investors must carefully assess their risk tolerance and financial goals before embracing variable rates. Balancing the potential for savings against the possibility of increased expenses is key to making informed decisions in this evolving interest rate environment.