In a competitive real estate market, variable rate loans offer buyers and investors an initial lower interest rate tied to the prime rate, providing flexibility if rates drop further. These loans save money during prime rate declines but come with risks of future rate increases. Lenders must assess creditworthiness while borrowers can protect against fluctuations through rate lock agreements or diversified portfolios for stable, mutually beneficial real estate arrangements.

In the dynamic landscape of real estate, understanding variable rate loans is paramount for both lenders and borrowers. This article delves into the intricacies of these financing options, focusing on how they work and their distinct benefits in the sector. We explore the symbiotic relationship between the prime rate and variable rates, unlocking financial flexibility. Furthermore, we navigate the risks and rewards associated with variable rate tied to prime loans in real estate lending, providing a comprehensive guide for stakeholders.

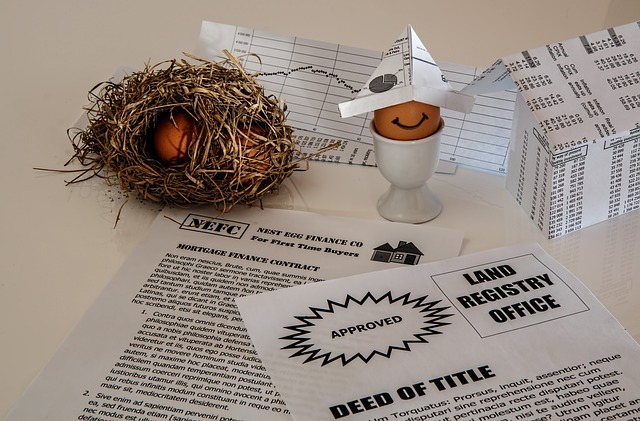

Understanding Variable Rate Loans in Real Estate: How They Work and Their Benefits

In the competitive landscape of real estate, understanding financing options is key for both buyers and investors. Variable rate loans stand out as a flexible and attractive proposition. These loans offer an initial, often lower, interest rate compared to traditional fixed-rate mortgages. The ‘variable’ in the name refers to the fact that the rate can fluctuate over time based on market conditions, typically tied to a benchmark index like the prime rate.

The benefits for real estate transactions are significant. Lower initial rates mean buyers can secure more favorable terms, potentially saving substantial amounts in interest payments during the initial loan period. This can be particularly advantageous in today’s dynamic market where interest rates can change rapidly. Additionally, these loans provide borrowers with the flexibility to refinance at a later date if rates drop further, allowing them to capitalize on better terms without penalty.

The Connection Between Prime Rate and Variable Rates: Unlocking Financial Flexibility

In the realm of finance, especially in Real Estate, understanding the connection between the prime rate and variable rates is a game-changer for borrowers and lenders alike. The prime rate, often referred to as the benchmark interest rate, is set by banks based on their cost of borrowing from each other. When this rate fluctuates, it has a direct impact on variable rates, which are tied to it. This connection offers financial flexibility in numerous ways.

For Real Estate investors and homeowners, variable rates can mean lower monthly payments during periods of declining prime rates. This is particularly beneficial when interest rates drop significantly, allowing borrowers to save money over the life of their loan. Conversely, when economic conditions improve and prime rates rise, variable rates adjust accordingly, providing a balance between cost savings and stability for both lenders and borrowers in the dynamic financial landscape.

Navigating Risks and Rewards: A Comprehensive Look at Variable Rate Tied to Prime in Real Estate Lending

In real estate lending, navigating the complexities of variable rates tied to prime is crucial for both lenders and borrowers. These structures offer a dynamic approach to interest pricing, where rates fluctuate in response to market conditions, often linked to benchmark indices like the Prime Rate. While this model presents attractive potential rewards, such as lower initial borrowing costs, it also introduces risks. Borrowers face the uncertainty of future rate increases, which can significantly impact their monthly payments and long-term financial obligations. Lenders, on the other hand, must carefully assess creditworthiness to mitigate default risks associated with variable rates.

A comprehensive understanding of market dynamics is essential for managing these risks. Lenders should consider factors like economic growth, inflation trends, and monetary policy decisions when setting terms. For borrowers, exploring options such as rate lock agreements or diversifying their investment portfolio can provide some protection against unpredictable rate fluctuations. By carefully evaluating the balance between risks and rewards, participants in real estate lending can make informed decisions, ensuring a more stable and mutually beneficial arrangement.